Cheyenne Credit Unions: Find the very best Regional Banking Solutions

Cheyenne Credit Unions: Find the very best Regional Banking Solutions

Blog Article

Maximize Your Savings With a Federal Lending Institution

Exploring the world of Federal Cooperative credit union for optimizing your cost savings can be a calculated financial step worth taking into consideration. The advantages, ranging from greater rate of interest rates to tailored cost savings options, supply an engaging opportunity to boost your financial wellness. By comprehending the benefits and alternatives readily available, you can make educated choices that line up with your cost savings objectives. Allow's dive right into the nuances of maximizing your cost savings potential with the special offerings of a Federal Credit Union and just how it can pave the way for an extra secure financial future.

Benefits of Federal Cooperative Credit Union

An additional secret benefit of Federal Lending institution is their concentrate on economic education and learning. They commonly supply sources, workshops, and individualized advice to aid participants boost their economic proficiency and make sound finance decisions. This commitment to empowering members with economic understanding collections Federal Lending institution in addition to various other banks. Federal Credit Unions are insured by the National Credit Union Administration (NCUA), providing a comparable level of protection for down payments as the Federal Down Payment Insurance Corporation (FDIC) does for banks. In general, the benefits of Federal Cooperative credit union make them an engaging option for people aiming to optimize their financial savings while getting individualized solution and support.

Subscription Qualification Standards

Subscription eligibility standards for Federal Credit history Unions are developed to manage the certifications individuals need to fulfill to end up being members. In addition, some Federal Credit score Unions may call for individuals to belong to a specific profession or sector to be qualified for membership. Understanding and meeting these standards is essential for people looking to sign up with a Federal Credit score Union and take benefit of the economic benefits they supply.

Savings Account Options Available

After determining your eligibility for subscription at a Federal Cooperative Credit Union, it is very important to explore the various financial savings account choices readily available click here to read to optimize your financial benefits. Federal Credit report Unions generally use a series of interest-bearing account customized to fulfill the varied requirements of their participants. One common option is a Routine Interest-bearing Accounts, which functions as a foundational represent members to deposit their funds and make affordable dividends. When needed., these accounts often have low minimum balance requirements and offer very easy access to funds.

Another popular selection is a High-Yield Interest-bearing Accounts, which supplies a greater rate of interest price contrasted to routine interest-bearing accounts. This sort of account is perfect for members looking to earn extra on their financial savings while still preserving flexibility in accessing their funds. In addition, some Federal Credit rating Unions provide customized interest-bearing accounts for particular financial savings objectives such as education, emergency situations, or retired life.

Tips for Conserving A Lot More With a Lending Institution

Aiming to improve your financial savings prospective with a Federal Cooperative Credit Union? Below are some pointers to assist you conserve better with a credit report union:

- Benefit From Higher Rates Of Interest: Federal Cooperative credit union typically offer greater rates of interest on savings accounts compared to standard banks. By depositing your funds in a cooperative credit union interest-bearing account, you can make even more passion over time, assisting your savings grow faster.

- Explore Different Savings Products: Lending institution provide a variety of financial savings products such as deposit slips (CDs), cash market accounts, and private retirement accounts (Individual retirement accounts) Each product has its own advantages and functions, so it's important to check out all options to locate the most effective suitable for your savings goals.

- Set Up Automatic Transfers: Set up automated transfers from your monitoring account to your lending institution financial savings account. In this manner, you can consistently add to your financial savings without needing to believe concerning it frequently.

Comparing Cooperative Credit Union Vs. Typical Bank

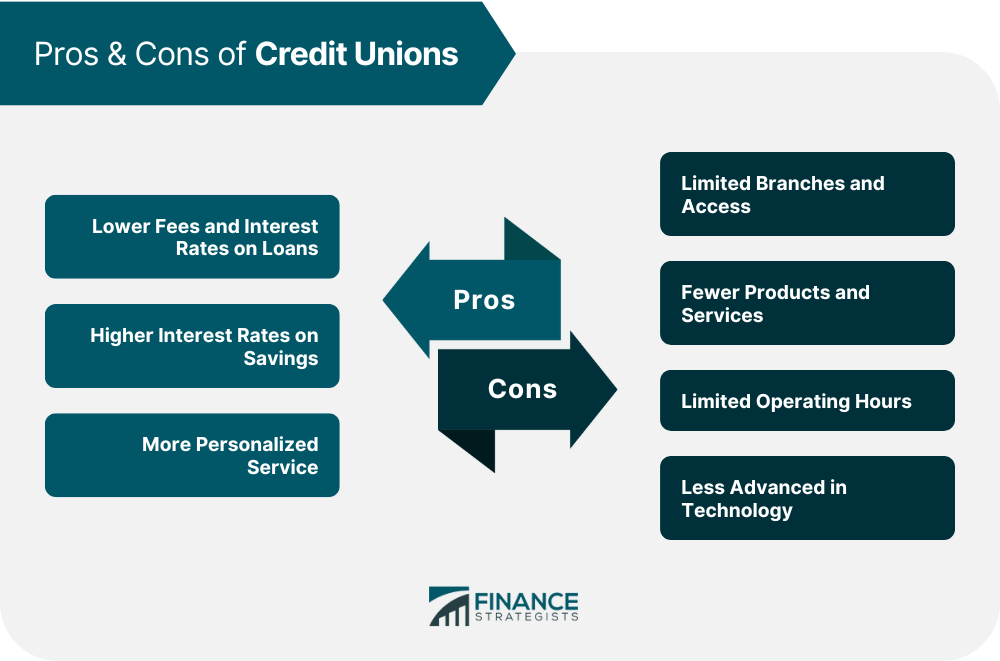

When evaluating financial establishments, it is essential to think about the differences between credit report unions and conventional banks. Lending institution are not-for-profit organizations had by their members, while typical financial institutions are for-profit entities owned by shareholders. This basic difference typically equates into far better rates of interest on interest-bearing accounts, reduced car loan prices, and fewer fees at lending institution compared to banks.

Lending institution commonly supply a more personalized approach to banking, with a focus on community participation and participant fulfillment. On the other hand, conventional financial institutions may have an extra substantial array of solutions and locations, however they can often be perceived as much less customer-centric as a result of their profit-oriented nature.

One check my site more key difference remains in the decision-making process. Cooperative credit union are governed by a volunteer board of supervisors chosen by participants, making sure that choices are made with the most effective passions of the members in mind (Credit Unions Cheyenne). Standard banks, on the various other hand, run under the direction of paid executives and shareholders, which can occasionally cause decisions that prioritize earnings over client benefits

Ultimately, the selection between a credit report union and a standard financial institution depends on individual preferences, economic goals, and banking demands.

Final Thought

To conclude, making best use of cost savings with a Federal Lending institution supplies numerous advantages such as higher rate of interest prices, reduced funding rates, decreased costs, and outstanding customer service. By benefiting from different interest-bearing account options and discovering various savings items, individuals can tailor their financial savings strategy to meet their economic objectives properly. Choosing a Federal Cooperative Credit Union over a standard bank can cause better financial savings and financial success over time.

Federal Credit score Unions are insured by the National Debt Union Management (NCUA), offering a comparable degree of protection for deposits as the Federal Down Payment Insurance Coverage Firm (FDIC) does for financial institutions. have a peek at this site Wyoming Federal Credit Union.After establishing your qualification for subscription at a Federal Credit History Union, it is crucial to discover the numerous financial savings account choices readily available to optimize your financial benefits. Furthermore, some Federal Credit history Unions give specific savings accounts for certain financial savings objectives such as education and learning, emergency situations, or retirement

By depositing your funds in a credit report union cost savings account, you can make more passion over time, helping your savings expand quicker.

Explore Different Cost Savings Products: Credit report unions provide a range of savings products such as certifications of deposit (CDs), cash market accounts, and individual retirement accounts (Individual retirement accounts)

Report this page